22th December 2022

In 2009, the Government of India launched a National Pension System (NPS) to enable India’s 400 million informal sector workers without pension benefits to voluntarily accumulate micro-savings for their old age. The NPS is among the most efficient pension programs in the world and has already resulted in mobilizing new long-term household savings of over $100 billion.

However, twelve years on, barely 5 million nonsalaried individuals have elected to open NPS accounts. The government as well as PFRDA, India’s pension regulator, have a deep demonstrated commitment to rapidly increasing pension coverage. However, encouraging massmarket outcomes with the NPS will require a segmented outreach and communications strategy coupled with sustained efforts on retirement literacy.

Digital footprint: Is there really an Urban-Rural divide?

According to a report released on June 3rd 2021 by Internet and Mobile Association of India (IAMAI), the total number of internet users in urban India by the end 2020 was 323 million persons or 64.6% of India’s urban population; similarly, the number for rural India was 299 million, or 32% of India’s rural population. It was also estimated that while urban users grew by 4%, rural users were actually growing by 13%, implying that by 2025, there will be more rural internet users than urban.

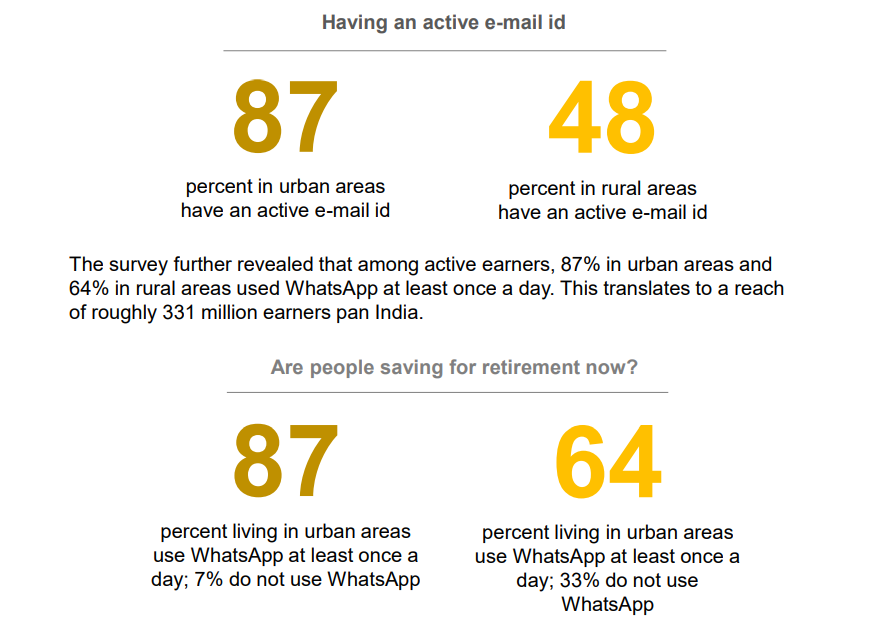

Further, according to a survey brought out by Sambodhi Panels and pinBox Solutions, the e-mail (active) penetration among earners (leaving out homemakers, students, and anyone else who does not work or has retired from work) is 87% in urban India and 48% in rural India. This translates to roughly 281 million earners as of 2021 who can be reached out through e-mail.

In aggregate, 153 million rural earners can be reached through their e-mail id, while even more (203 million) can be reached via WhatsApp. These numbers are certainly significant when considering that digital connectivity has now become a prerequisite for the delivery of financial services in India.

These findings are excerpts from a survey that was conducted by Sambodhi and PinBox Solutions have collaborated to produce a survey on digital and financial inclusion. This survey was conducted by telephone, covering 7924 urban respondents and 4243 rural respondents. This was a pan-India survey. In urban areas, the sample was spread amongst relatively upper-middle and high-income earners (35%), relatively middle and lower middle-income earners (34%), and relatively low-income earners and economically weaker sections (31%). In rural areas, the sample covered relatively affluent earners, including medium and large farmers (38%), relatively middle-income earners (39%), and relatively poor earners, including wage labourers (23%).