Prologue

Consumer sentiment—often used interchangeably with consumer confidence, is a statistical measurement of the overall health of the economy as determined by consumer opinion. It takes into account people’s feelings toward their current financial health, the health of the economy in the short term, and the prospects for longer-term economic growth, and is widely considered to be a useful economic indicator. When people feel confident about the stability of their incomes it influences their spending and saving activities.

Evaluating consumer sentiment is one of the cornerstone components of sound market research at the micro level and policy advocacy at the macro level. By effectively gauging consumer attitudes, behaviours, and beliefs, a business can craft messages, reach its target audience, and take actions to strengthen customers’ affinity, loyalty, and perceptions of your company in ways that can drive stronger business results.

India’s consumer sentiment: May-June 2022

At the same time, social welfare and other development policies can often be influenced by gauging the prevalent consumer sentiment, including electoral strategy.

This survey follows the methodology of Michigan University’s survey of consumers which they have been carrying out in the US since 1972. The broad areas covered include the current state of personal finances, the state of the country’s economy and what the future holds, financial and employment security, consumption sentiment, what ails the nation and confidence in government, and finally, the overall state of happiness.

Coverage

The survey, conducted through a telephonic panel, covers 15514 individual earners living in 22 states. The rural sample is 7221 and the urban sample is 8293. The survey has been designed to be representative of the ground reality, with quota-based coverage of younger and older earners, as well as representation from the relatively high-income (5643), middle-income (6549), and low-income (3322) earners and economically weaker sections. This survey was conducted during the period of March to May 2022.

All respondents were earners. Six questions were asked as part of this segment of the research, viz.

- “Looking back, would you say that your (and your household’s) current financial situation these days was better off, about the same, or worse off as compared to last year?”

- “Looking ahead, do you think that a year from now, you (and your household) will be better off financially, or worse off, or just about the same as now?”

- “Now turning to the economic conditions in the country as a whole, do you think that during the next twelve months we’ll have good times financially, or bad times?”

- “Looking ahead, which would you say is more likely to happen – that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or will the situation continue to get worse as time progresses?”

- “Generally speaking, do you think now is a good or bad time for people to buy major household items like new furniture, a refrigerator, a new TV, and things like that?”

- “How confident are you in being able to buy a house/land within the next 5 years?”

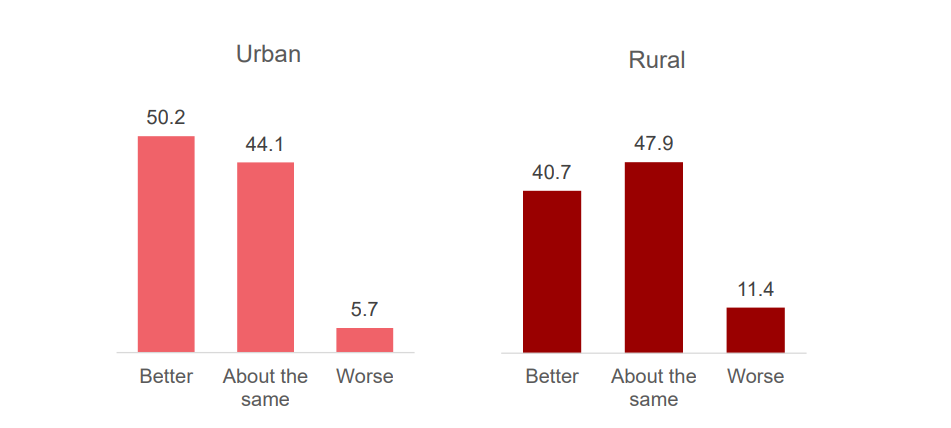

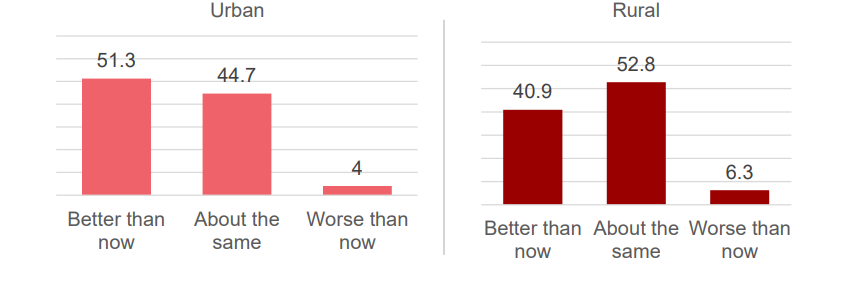

Looking back, would you say that your (and your household’s) current financial situation these days was better off, about the same, or worse off as compared to last year?

Given that 2021 was a tough year in terms of COVID-related disruptions, close to half of the earners confirmed that there has been some sort of economic recovery. However, the recovery was ten percentage points higher in urban areas than in rural.

Overall, the relatively higher proportion of the high-income category of earners has registered a recovery while low-income earners have tended to remain static in their earnings. However, given that low-income earners account for the bulk of India’s workforce, the fact that over 80% have managed to retain their earnings or even improve upon them is clearly a positive testament to India’s economic resilience.

Given that home is a principal point of consumption, a concentrated awareness campaign targeting parents is the likely way forward.

The obesity problem is not just a personal problem -it can have a huge effect on the local and global economy. Obesity can lead to non-communicable diseases, like cardiovascular cancers and diabetes. It also means higher healthcare costs, higher absenteeism from work, and lower productivity. The World Bank has been prescribing several means to address this problem, including taxation on unhealthy foods, namely sugar-sweetened items like soft drinks and high-fat foods, and front-of-package labelling, especially on processed foods. Perhaps it is time for India to sit up and listen.

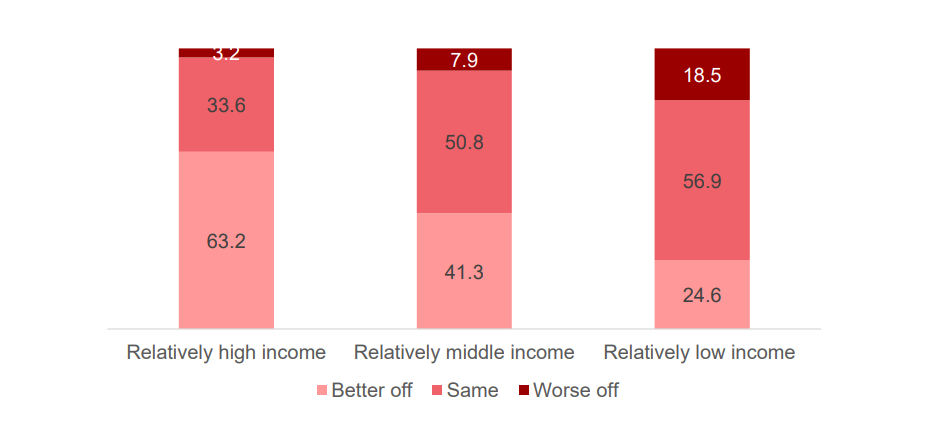

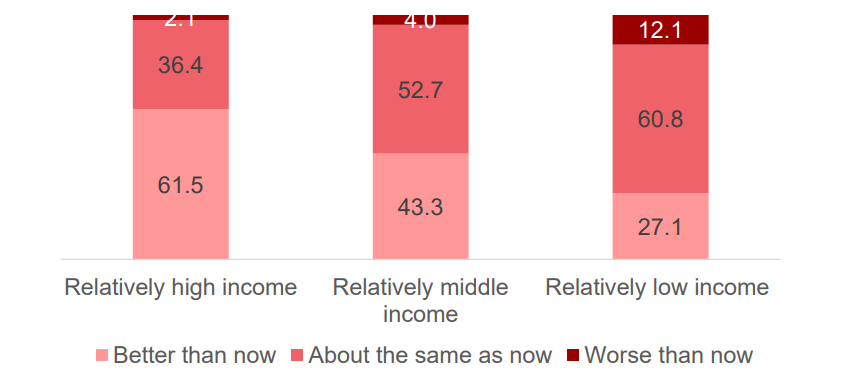

Looking ahead, do you think that a year from now, you (and your household) will be better off financially, or worse off, or just about the same as now?

Looking forward, there is a certain degree of optimism with nearly half of the earners stating that they thought they would be financially better off a year from now. This was lower in the case of rural India (41%) as compared to urban (51.3%).

Looking ahead, do you think that a year from now, you (and your household) will be better off financially, or worse off, or just about the same as now?

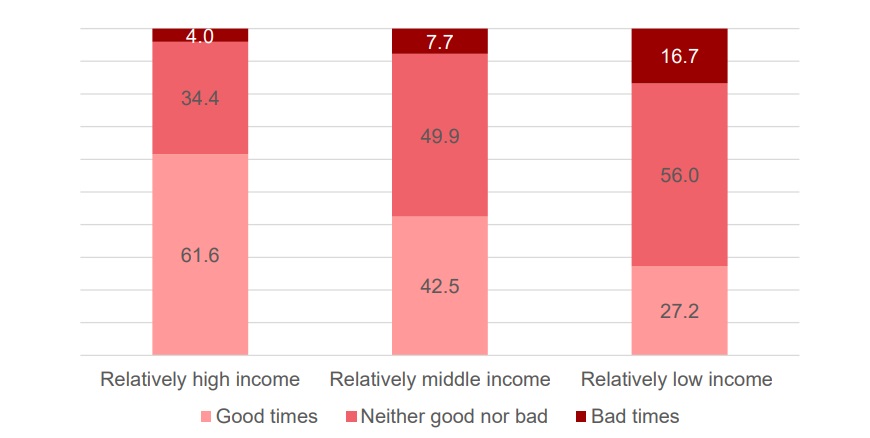

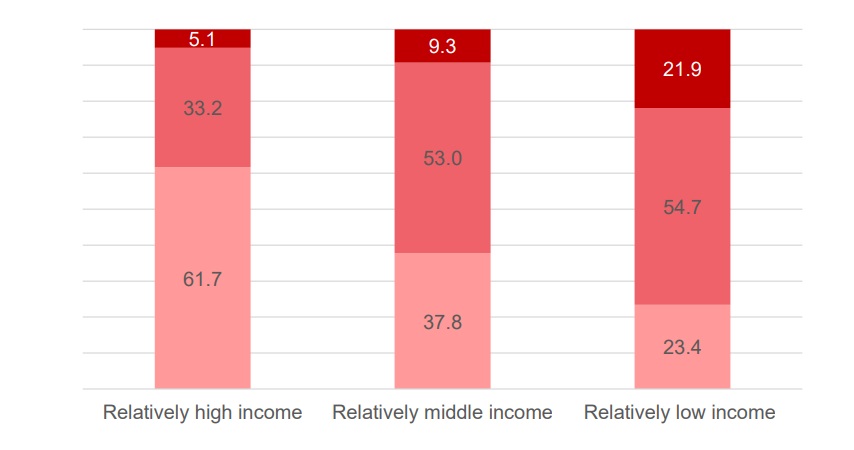

As expected, optimism was highest in the higher-income category of respondents (61%) but progressively getting lower down the income chain and lowest in the low-income owner category, where it was only 27%. However, even in the low-income group, as high as 60% at least expected earnings to remain static and not go down any further than what it was at present.

Now turning to the economic conditions in the country as a whole, do you think that during the next twelve months we’ll have good times financially, or bad times?

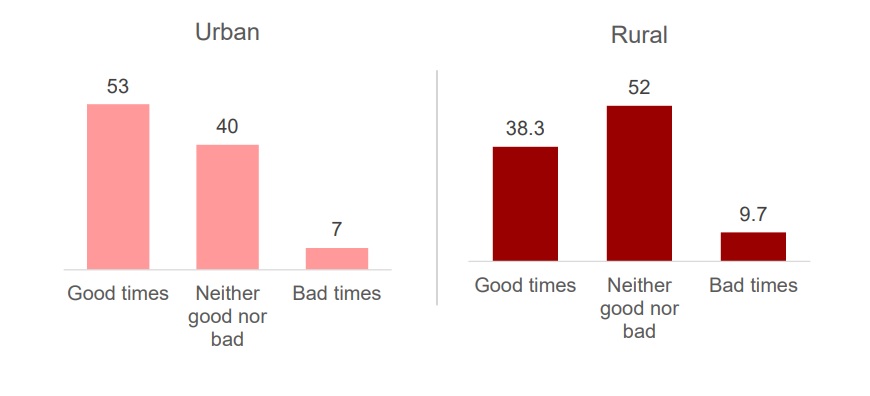

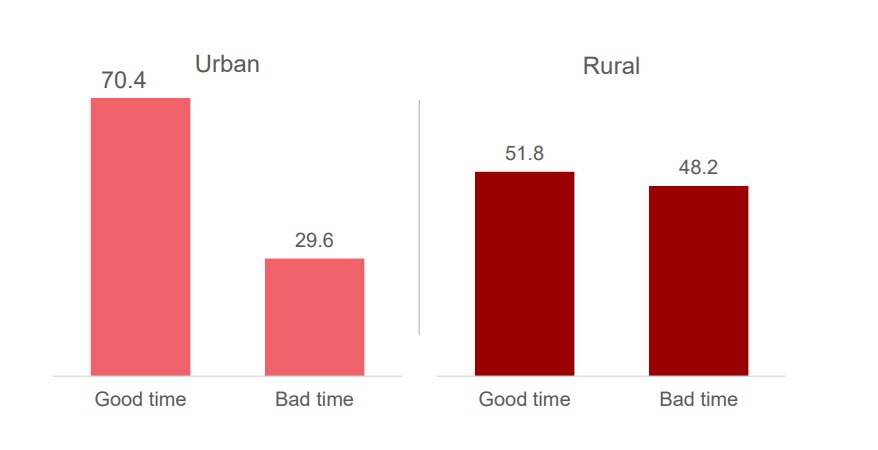

When it came to the economic condition of the country as a whole, once again we see a certain degree of optimism. This optimism was high in urban India with 53% stating that they expected good times to come over the next 12 months. On the other hand, only 38% in rural India expected good times to come over the coming 12 months, and just over half felt that conditions will remain unchanged.

Now turning to the economic conditions in the country as a whole, do you think that during the next twelve months we’ll have good times financially, or bad times?

When it came to the economic condition of the country as a whole, once again we see a certain degree of optimism. This optimism was high in urban India with 53% stating that they expected good times to come over the next 12 months. On the other hand, only 38% in rural India expected good times to come over the coming 12 months, and just over half felt that conditions will remain unchanged.

Looking ahead, which would you say is more likely to happen – that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or will the situation continue to get worse as time progressed?

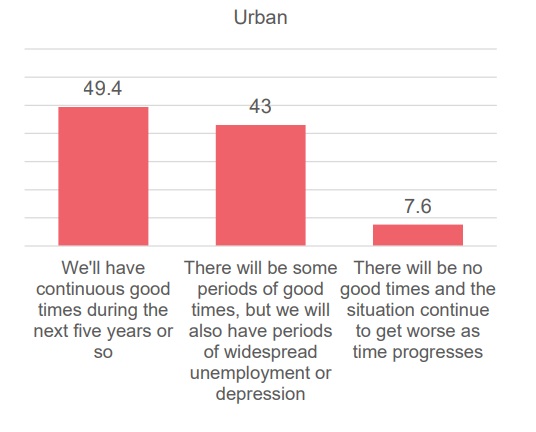

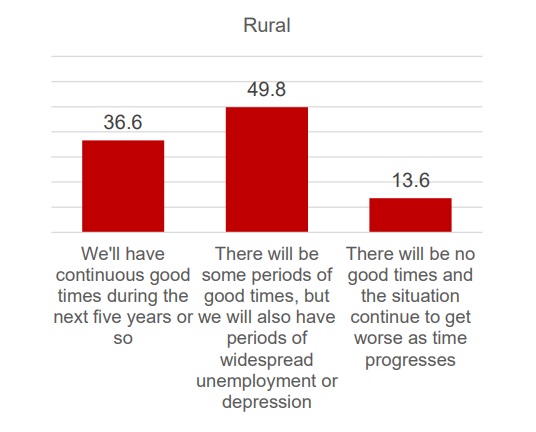

Most people who thought that the next 12 months will usher in good times were optimistic about the fact that good times would likely be the norm over the next five years. In fact, 49% of urban India and 37% of rural India held such an opinion. However, close to half of the earners were more pragmatic and they expected good times interspersed with bad times to be the norm in the country five years ahead.

Looking ahead, which would you say is more likely to happen – that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or will the situation continue to get worse as time progressed?

There will be no good times and the situation continue to get worse as time progresses

There will be some periods of good times, but we will also have periods of widespread unemployment or depression

We’ll have continuous good times during the next five years or so

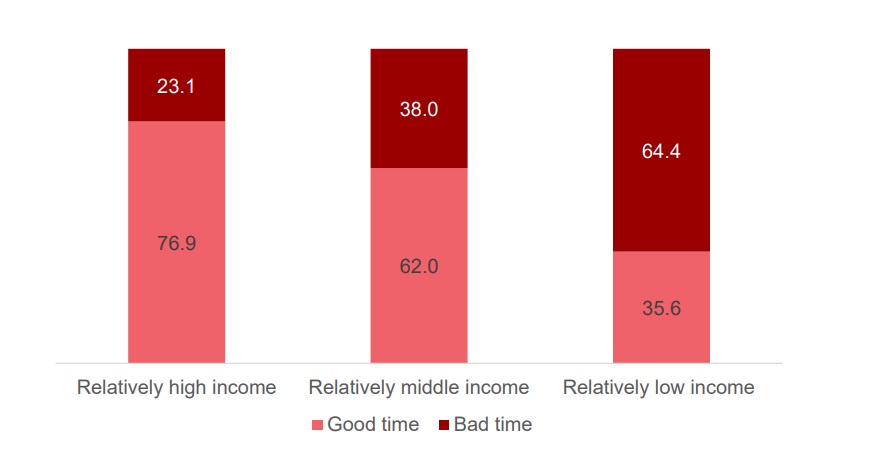

Among the relatively lower income groups, just 23.4% were upbeat about the future unconditionally. In fact, more than one in five of the low-income category felt that there is likely to be no good times in the next five years.

Generally speaking, do you think now is a good or bad time for people to buy major household items like new furniture, a refrigerator, a new TV, and things like that? get worse as time progressed?

Nearly two out of three survey participants were of the opinion that this is a good time to buy major household items including consumer durables. However, this sense of optimism was much more in urban India as against rural India.

As expected, very low 35% of the low-income earners held the opinion that this was a good time to buy consumer durables. It was the upper and middle-income participants who were optimistic about their current and future earnings and hence endorsed the idea that it was a good time to invest in consumer durables. This sense of optimism had bypassed almost 2 out of 3 earners who were at the lower end of the income spectrum.

As an extension to the above question, respondents were also asked whether it was a good time to buy a car or a house. Among the high and middle-income respondents in urban India and the high-income earners in rural India 35% in the case of the former and 43% in the case of the latter were themselves not confident of buying a car within the next five years. Similarly, among the high-income group and the middle-income group respondents in urban India (we excluded rural as buying a house was deemed to be more of an urban phenomenon), over 41% were not confident when it came to buying property within the next five years.